Research on asset allocation tells us that it is better to have lots of baskets for your eggs and, over time, the eggs increase in number and size. Concomitantly, the aggregate of the baskets experience less volatility because some baskets are non-, and negatively, Correlated in markets with the other baskets. So what happens when you want to add a little rocket fuel to just one of those baskets? Enter the Core-Satellite approach to portfolio construction.

It is important to keep in mind that this is not a recommendation, but merely an example of an approach to investing that has, and hasn’t,worked for investors.

How it works:

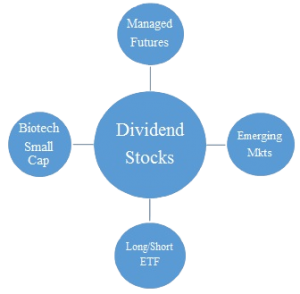

The Core-Satellite approach to portfolio construction is a sound way to explore risk and volatility while controlling how much of the assets are exposed to increased levels of that risk. Very simply, the “Core” in the title would be the largest percentage of those investableassets. Necessarily, the investor would encourage manageable risk tolerances for that allocation and, in fact, should court a bit lowerthan acceptable risk. The rationale behind that approach is that the “Satellite” positions can assume more levels of risk, even speculative, so that the blended risk experience for the investor is within their tolerable range. This is a conventional way to explore those “homeruns” whileKeeping most of the assets on track for hitting “singles.” Here is a graphic to help illustrate the construct: