It is tough to find income that is stable and consistent, when market interest rates are so incredibly low. Complicating this dynamic is the likelihood of suppressed interest rates for the next 5-10 years. Its not surprising that investors are willing to listen to discussions about income harvesting strategies when faced with that kind of outcome.

We surveyed a few of our strategic partners in the fixed income and alternative income space to see what they were doing to solve the income dilemma. From that group we picked one that seems to be easy to understand and explain. Additionally, we really wanted to present something that had very low risk to income capital. So, with that being said, here is our pick for this quarter:

The Split Annuity Strategy

The Split Annuity Strategy is something we have executed with clients in the past and found very positive results. Though annuity strategies are not our first line of defense when allocating client assets, we do consider them as an asset class. Furthermore, when used properly and ethically, they can be a tremendous opportunity to shift a portion of capital risk to another party – the insurance carrier.

The Split Annuity Strategy is fairly simple and does not require a great deal of heavy lifting on behalf of the client. Here are the steps and benefits to this type of strategy:

- The strategy should be executed only after the adviser and client understand the overall long-term goals of all client assets. As a rule of thumb, the strategy should only be considered for a defined percentage of the overall investable assets. Only in very rare cases should this strategy be considered for all of the investable assets, and the other important advisers in the client’s life should be consulted, such as the attorney and the CPA.

- Two types of annuities should be used for this strategy:

-

-

- - The Immediate Annuity*

- - The Immediate Annuity allocates the client assets to a fixed interest rate bucket and then annuitizes the income stream over a fixed duration of time, or for the lifetime of the annuitant (insured).

- - The Fixed or Equity Indexed Annuity

- - The Fixed, or Equity Indexed, Annuity provides a minimum interest rate guarantee for the duration of the contract (life of the annuity).

-

- Here is how the strategy works:

-

-

- - Client “A” has $1,000,000 of investable assets for retirement. Though it is not an industry rule, the adviser should consider only about 33% of the assets for this strategy. In this example, we will allocate 20% to the Split Annuity Strategy, or about $200,000.

- - Of the $200,000 of assets, the adviser carefully selects an immediate annuity from a reputable carrier to secure annuitization and immediate income.

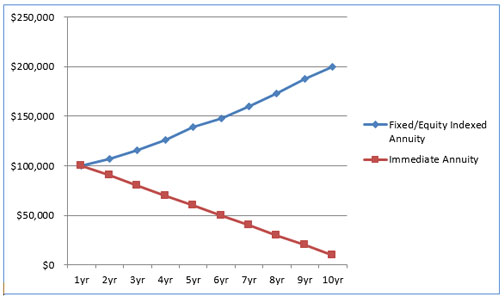

- - $100, 000 is secured for the immediate annuity and another $100,000 is placed in a fixed, or equity, indexed annuity.

-

- The adviser should carefully select a fixed, or equity, indexed annuity so that the growth of the assets coincides with the last payments from the

immediate annuity. Optimally, consideration should be given to annuity policies and carriers that can come close, if not achieving, a doubling of the assets during the immediate annuity distribution period.

- Since the Fixed/Equity Indexed Annuity remains untouched for distribution purposes, it continues to grow. The graphic below illustrates this activity over time. Keep in mind, these numbers are for illustrative purposes, and your particular outcome in this strategy will be determined by the annuity products used, income needed over time and general condition of the annuity company providing the guarantees.

As we stated before, consistent income strategies are a difficult pursuit during such low interest rate environments. However, with a focus on alternative sources and blended strategies that mitigate risk and provide asset stability, investors should be able to reach their income goals over time.

If you have any questions about this strategy, or would like to explore other ideas, please reach out to your BlueSkye Adviser, or simply send us an email at info@blueskyegroup.com and we would be happy to meet your needs.